Share This Article:

HR Homeroom

Identity theft has overwhelmed the Internal Revenue Service (IRS) resulting in a backlog of 500,000 unresolved fraud cases, leaving taxpayers without refunds and credits that are due to workers, according to a recent report by the National Taxpayer Advocate to Congress.

The report by the agency’s watchdog described the slow pace of addressing the identity theft cases as a “blemish” on the performance of the IRS, which is in the midst of a modernization campaign that aims to improve taxpayer services.

“Part of the problem stems from lack of personnel. IRS employment dropped from 100,000 to about 70,000 today,’’ said Robert Strauss, a professor of economics and public policy at Carnegie Mellon University.

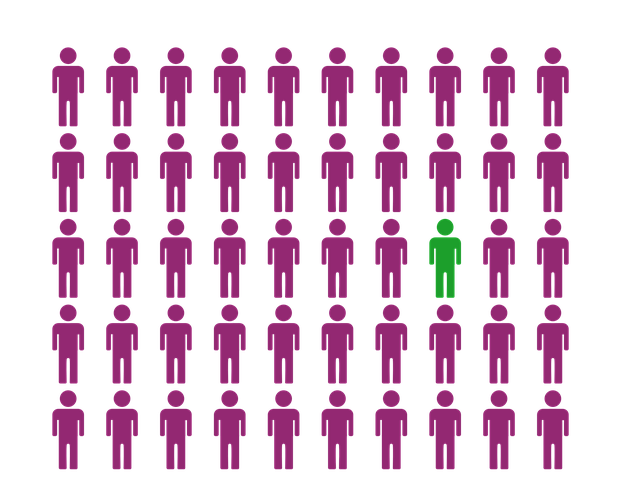

The IRS is taking nearly two years to resolve identity theft victims’ assistance and has an inventory of 500,000 cases, up from 484,000 cases in September 2023. “IRS delays in resolving identity theft cases are unconscionable,’’ Erin Collins, the taxpayer advocate wrote in the report.

The report also said that “delays of nearly two years make a mockery of the right to quality service in the Taxpayer Bill of Rights. ‘’

The backlog of cases is likely to give congressional Republicans more fodder to criticize the IRS and call for pushing back some of the $80 billion in funding the agency received from the Inflation Reduction Act in 2022, according to Strauss.

Agency critics have been arguing that the IRS is bloated and failing to put that money to good use.

The IRS said in a statement that it recognizes that the backlog in indentity theft remains one of its most significant ongoing service gaps, and it is working to implement a “range of improvements’’ to provide faster service to victims. That includes directing more staff to work in the area.

Still, retirees like Sally Mott of Lincoln Park, N.J. say she is worried about filing her 2024 taxes because she was a victim of identity theft. “My bank accounts and tax returns are all messed up, and I am on a fixed income,’’ she added.

The National Taxpayer Advocate said that most victims of identity theft were on the lower end of the income scale and often needed their refunds and refundable tax credits to pay for living expenses.

“The IRS is revictimizing taxpayers by making them wait nearly two years to resolve their case and receive their refund,’’ the report said.

The report also revealed that the IRS was using an outdated methodology to track how quickly it tracked calls and that most callers were disconnected or rerouted to automated operators.

The IRS was originally given $80 billion to upgrade its technology and its enforcement capabilities, but Congress knocked back approximately $20 billion of

those funds last year during a spending fight between Democrats and Republicans.

The IRS is expected to process more than 160 million returns this filing season from individuals and businesses.

california case management case management focus claims compensability compliance courts covid do you know the rule emotions exclusive remedy florida FMLA fraud glossary check health care Healthcare hr homeroom insurance insurers iowa leadership medical NCCI new jersey new york ohio osha pennsylvania roadmap Safety state info technology texas violence WDYT west virginia what do you think women's history women's history month workcompcollege workers' comp 101 workers' recovery Workplace Safety Workplace Violence

Read Also

About The Author

About The Author

-

Chriss Swaney

Chriss Swaney is a freelance reporter who has written for Antique Trader Magazine, Reuters, The New York Times, U.S. News & World Report, the Burlington Free Press, UPI, The Tribune-Review and the Daily Record.

More by This Author

Read More

- Apr 18, 2025

- Claire Muselman

- Apr 18, 2025

- Liz Carey

- Apr 18, 2025

- Claire Muselman

- Apr 18, 2025

- Chris Parker

- Apr 16, 2025

- Frank Ferreri

- Apr 16, 2025

- Claire Muselman