Share This Article:

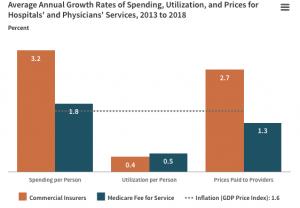

The prices private insurers have paid to hospitals and physicians have increased much faster than prices paid by Medicare and Medicaid.

And it’s not because providers are cost-shifting.

Those are the main takeaways from a just-released CBO report; here’s what CBO said (emphasis added):

- commercial insurers pay much higher prices for hospitals’ and physicians’ services than Medicare FFS does.

- In addition, the prices that commercial insurers pay hospitals are much higher than hospitals’ costs.

- Paying higher prices to providers can have several effects.

- First, it can increase insurers’ spending on claims, which may lead to higher premiums, greater cost-sharing requirements for patients...

- Second, it can increase the federal government’s subsidies for health care .

- And third, it can slow the growth of wages.

- The share of providers’ patients who are covered by Medicare and Medicaid is not related to higher prices paid by commercial insurers. That finding suggests that providers do not raise the prices they negotiate with commercial insurers to offset lower prices paid by government programs (a concept known as cost shifting).

Ok, that said, these are findings based on national data…things are different market to market.

I’d note that price increases in workers’ comp correlates with states’ Medicaid expansion. That is, price inflation is generally much higher in states that did NOT expand medicaid.

More on that here.

What does that mean for you?

Private insurers aren’t doing their job very well.

By Joe Paduda

Courtesy of Managed Care Matters

More by This Author

- Feb 10, 2025

- WorkersCompensation.com

- Oct 02, 2024

- WorkersCompensation.com

- Jun 24, 2024

- WorkersCompensation.com

Read More

- Mar 26, 2025

- Liz Carey

- Jan 30, 2025

- Liz Carey

- Aug 12, 2024

- Frank Ferreri

- Aug 06, 2024

- Frank Ferreri

- Aug 05, 2024

- Frank Ferreri