Share This Article:

White Papers

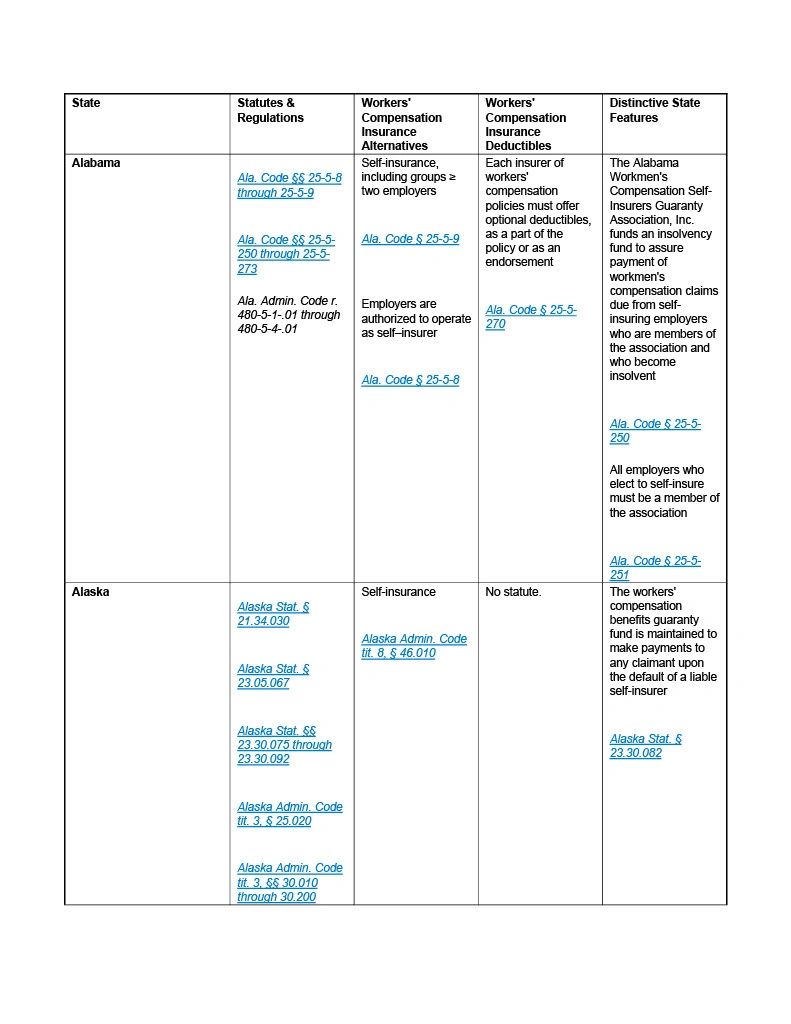

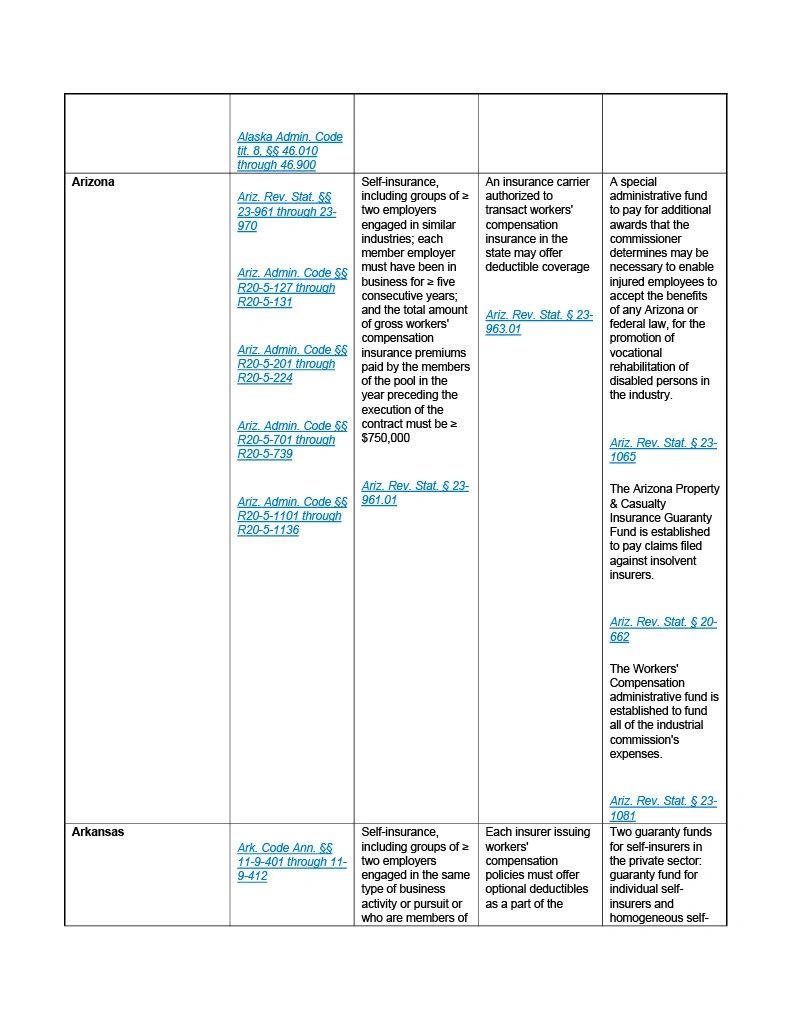

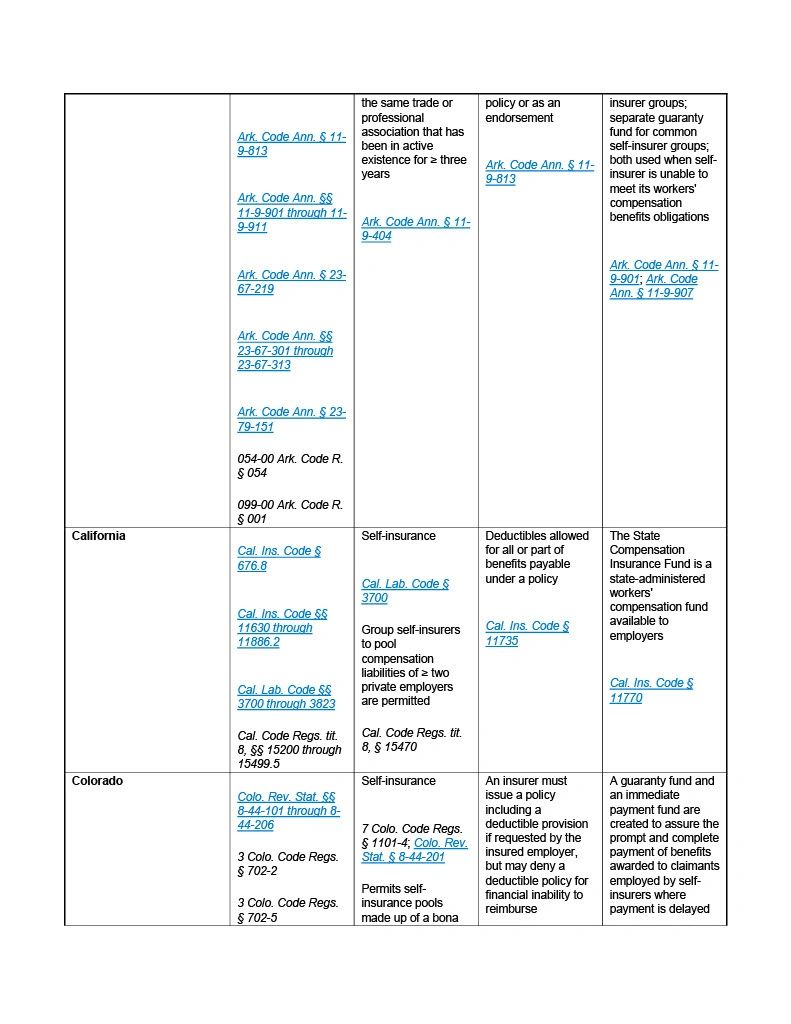

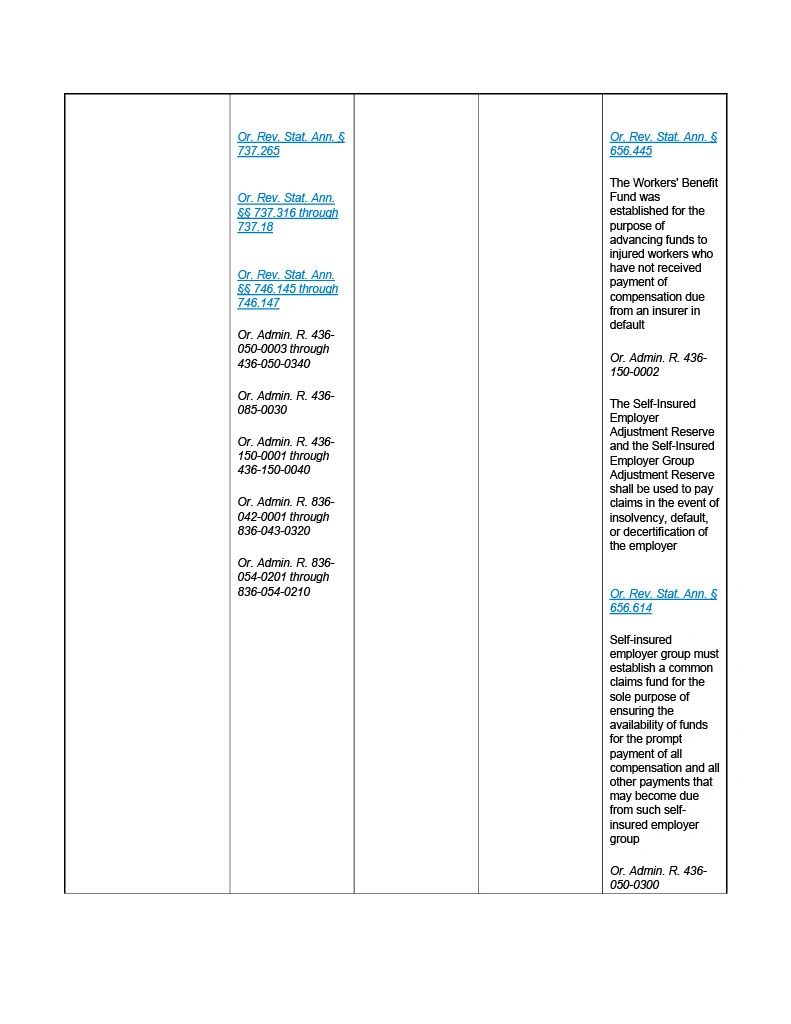

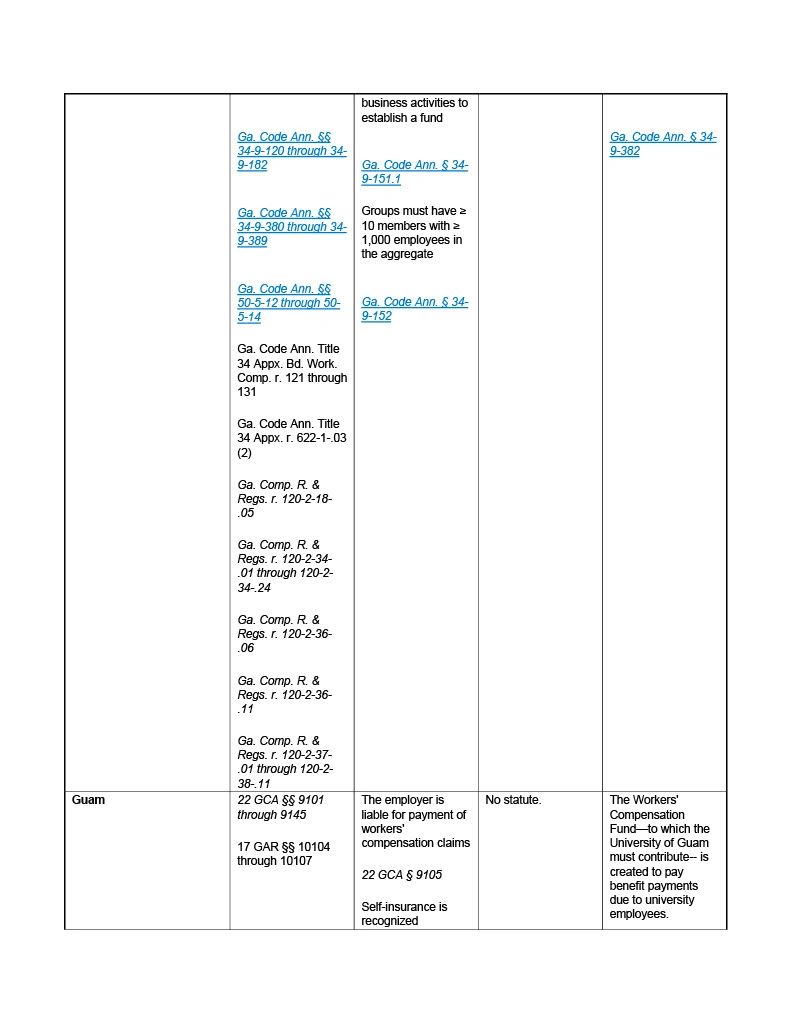

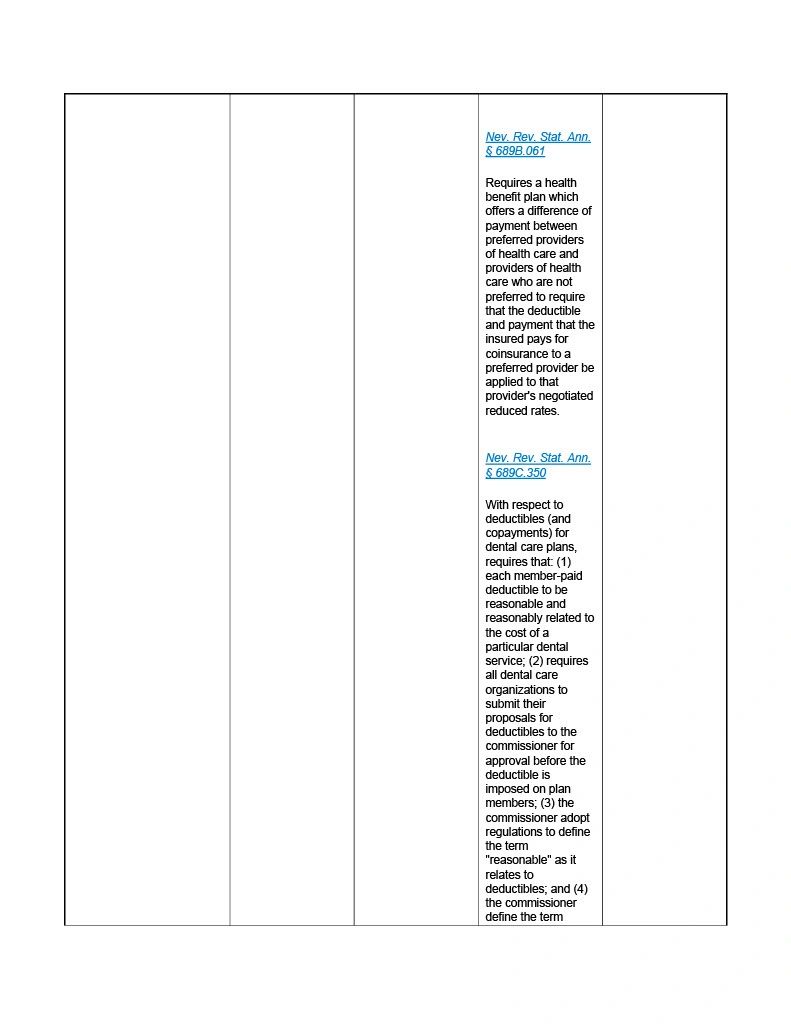

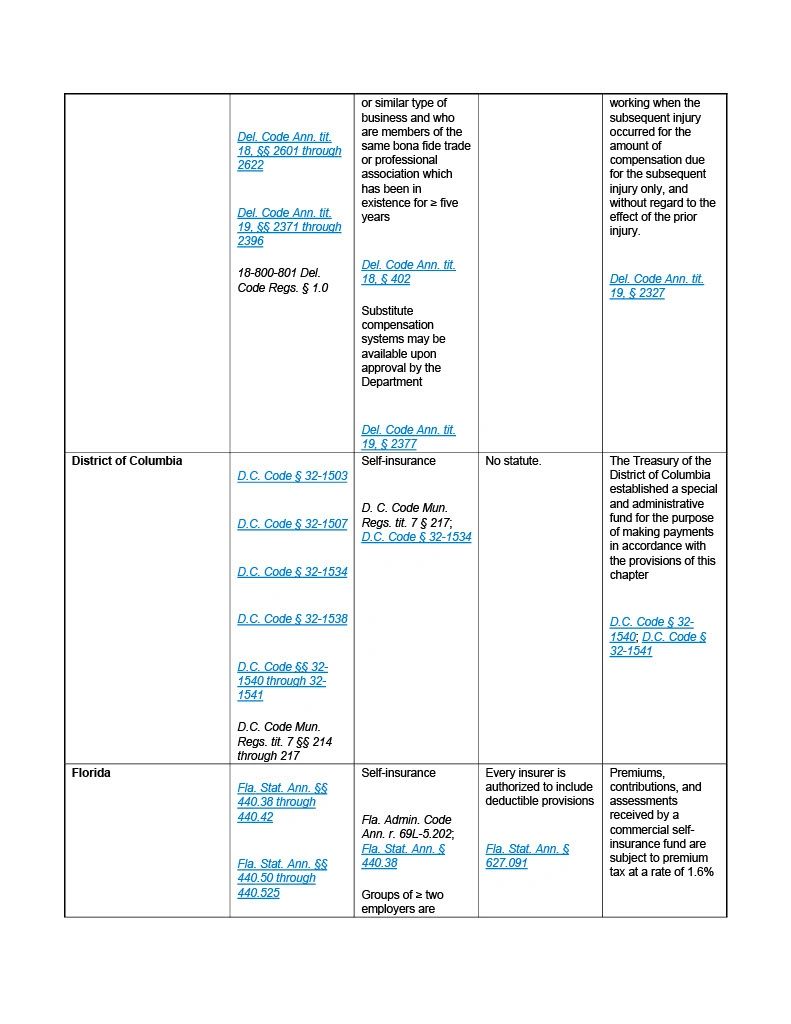

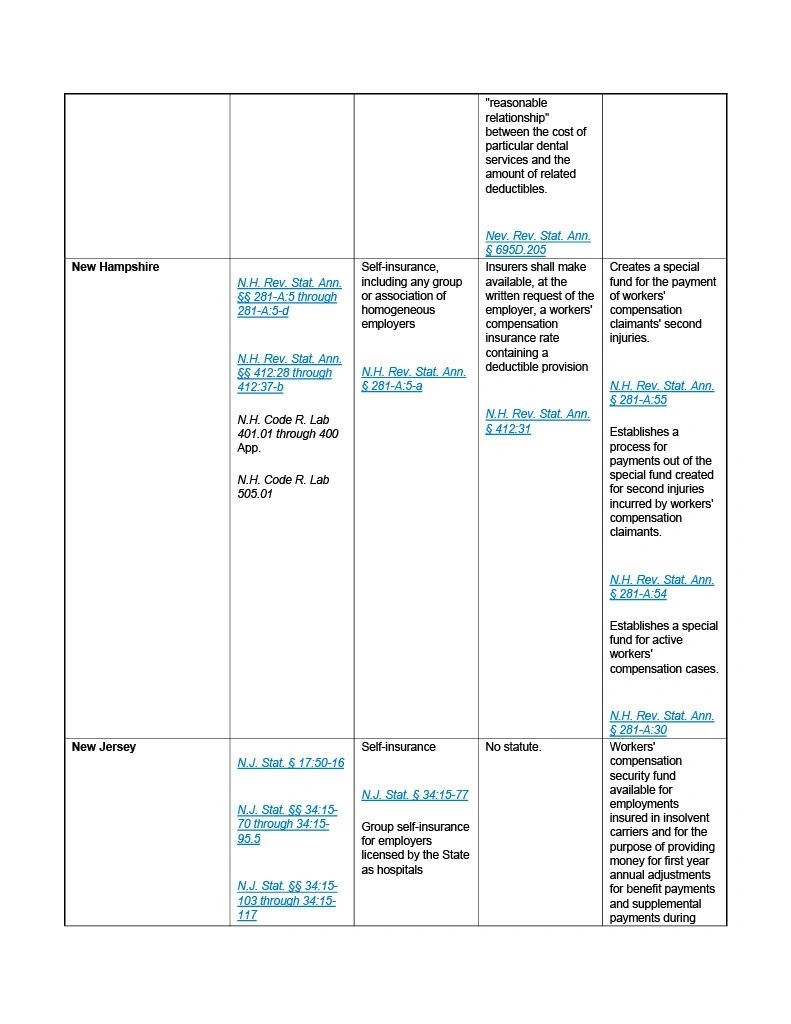

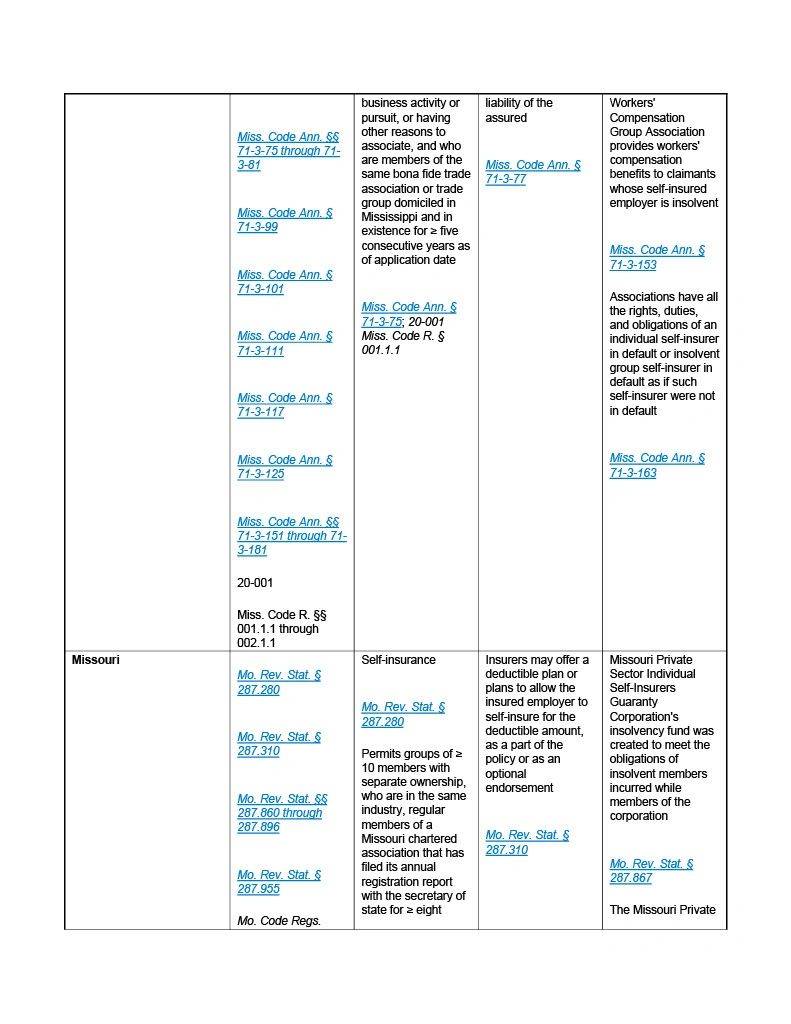

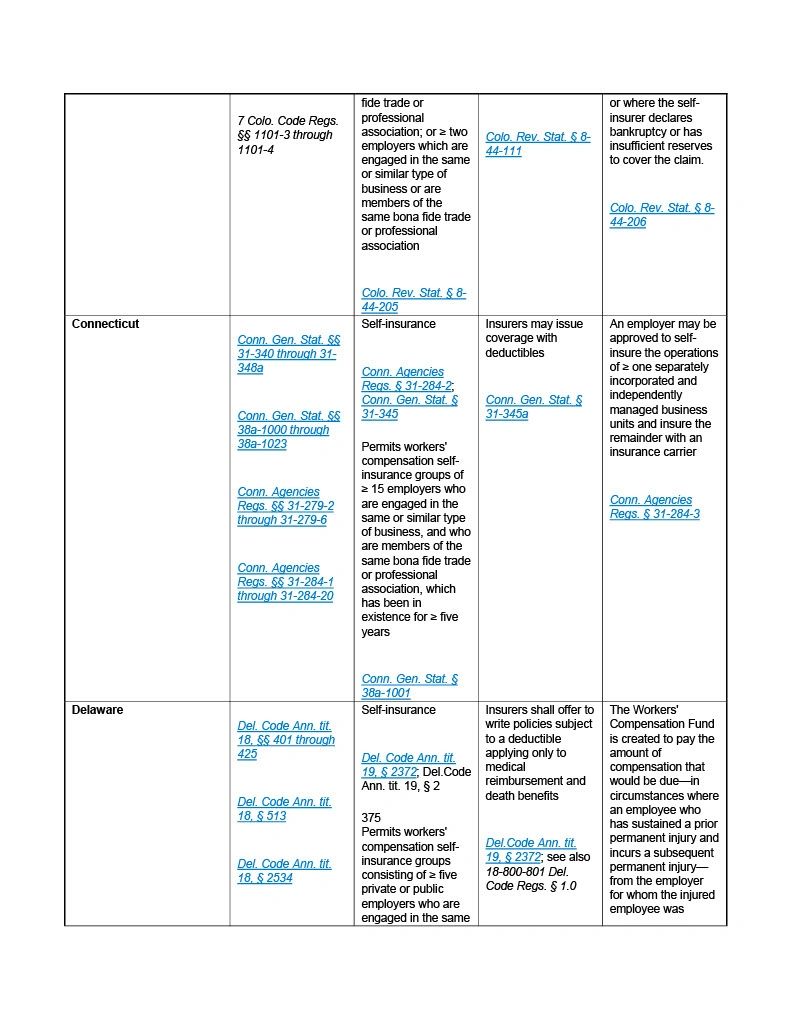

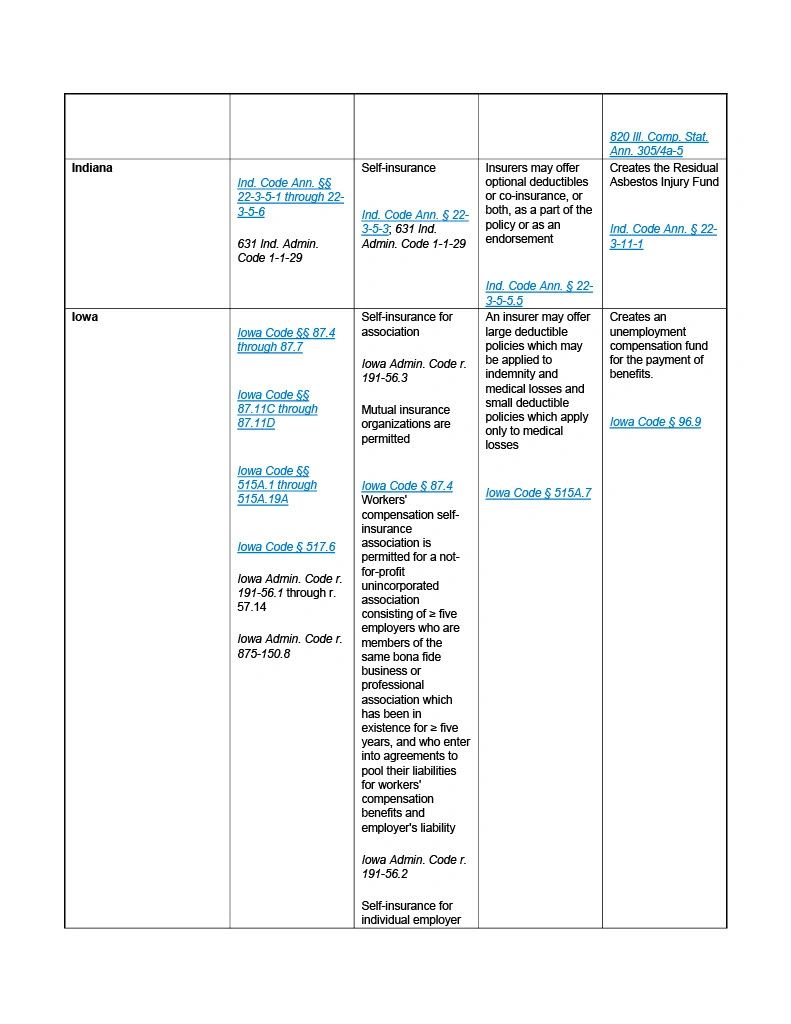

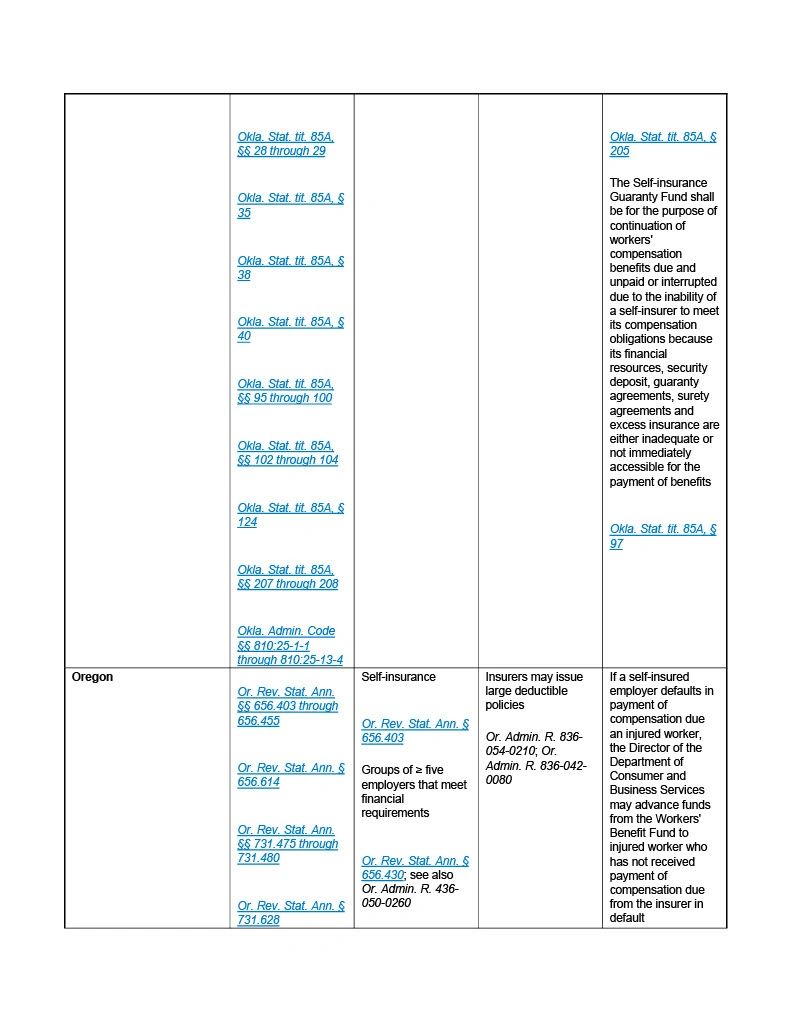

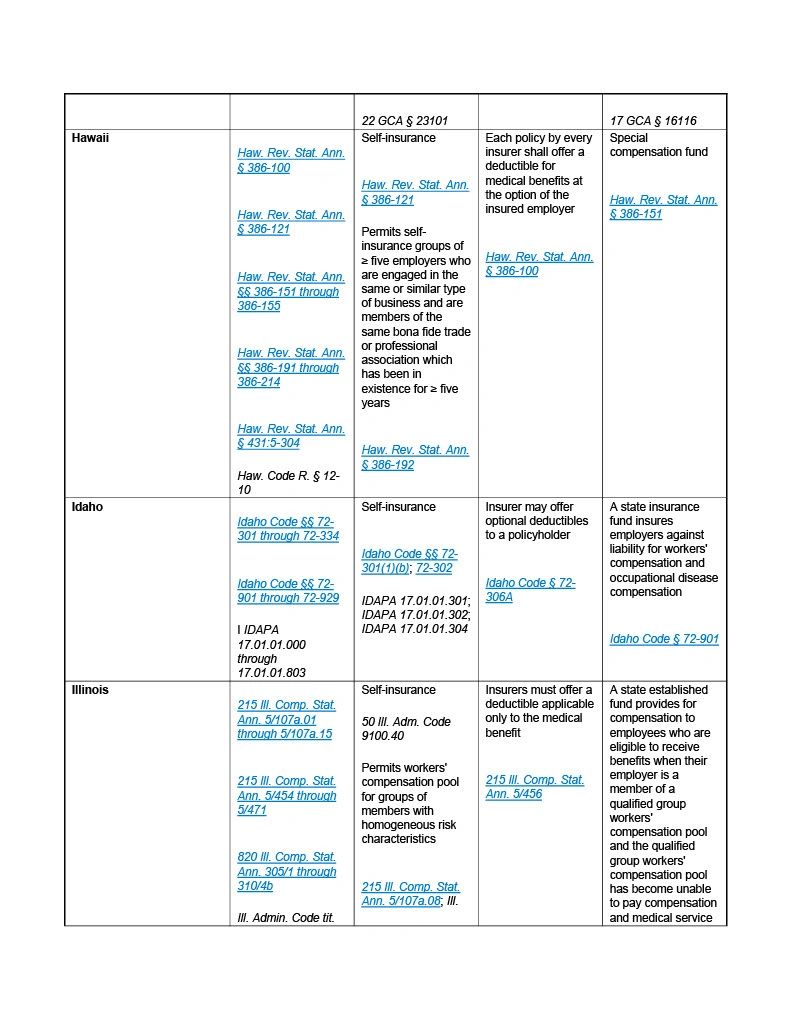

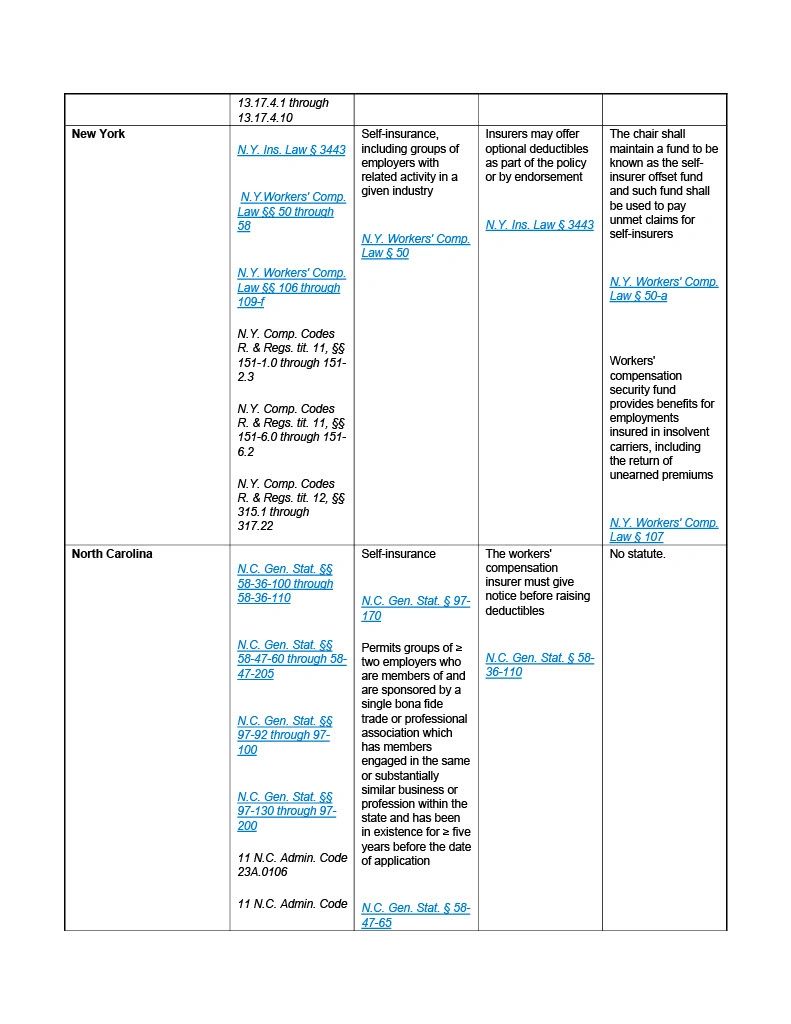

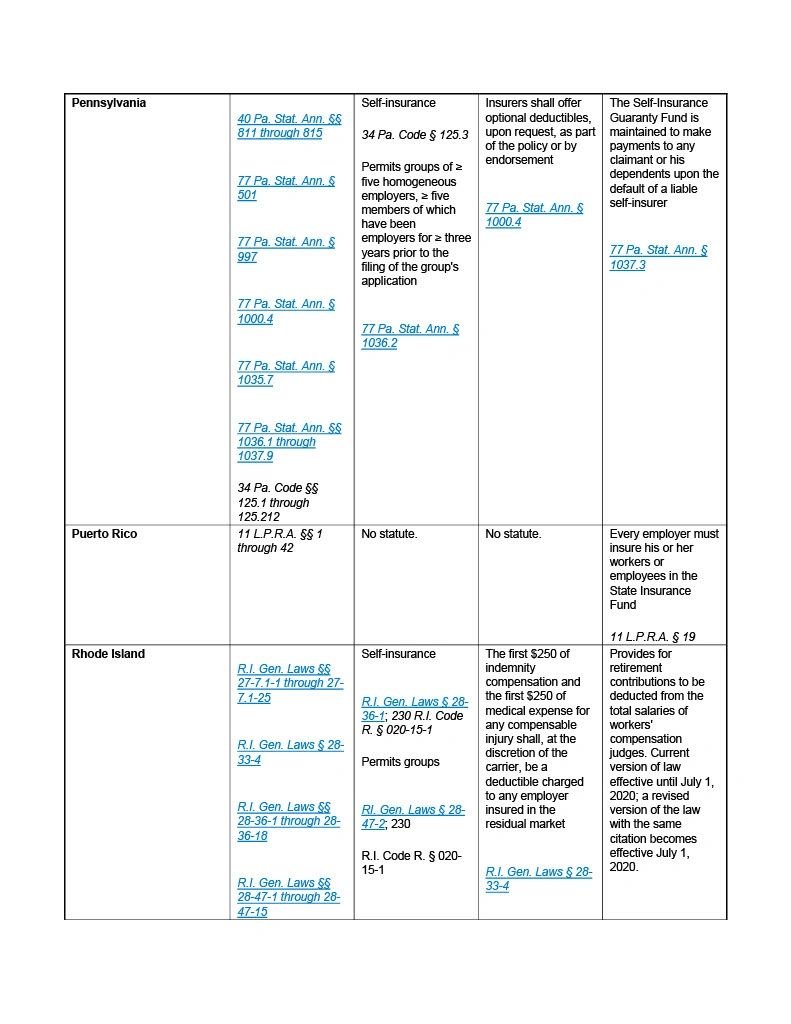

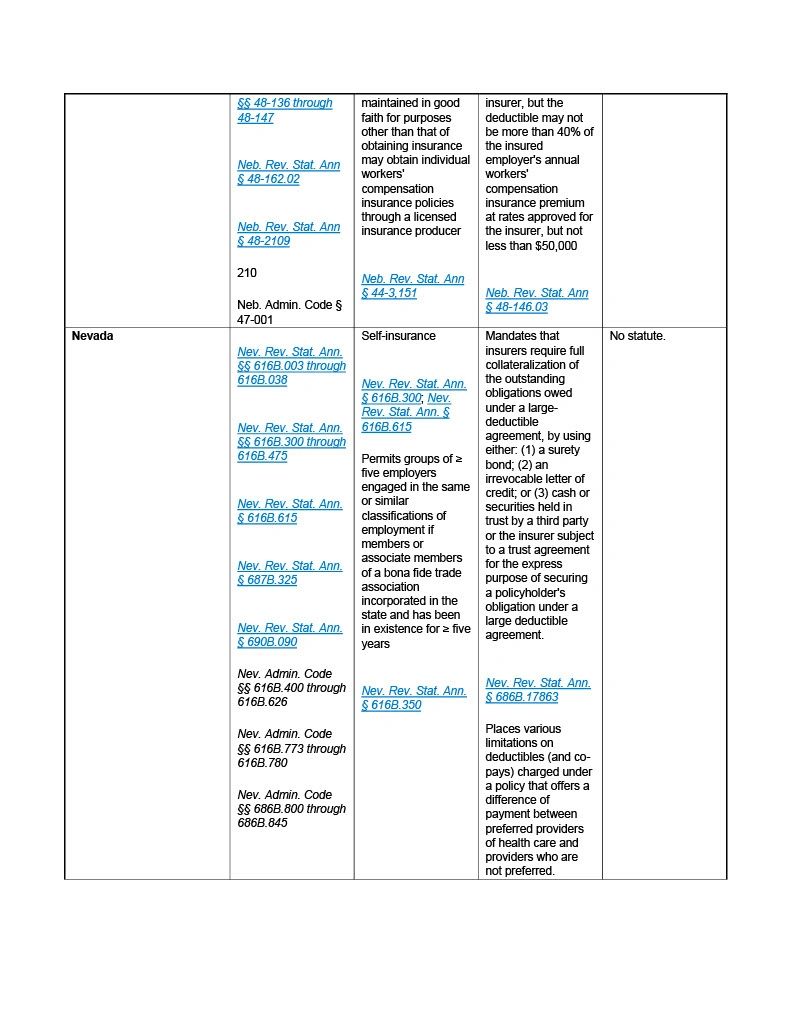

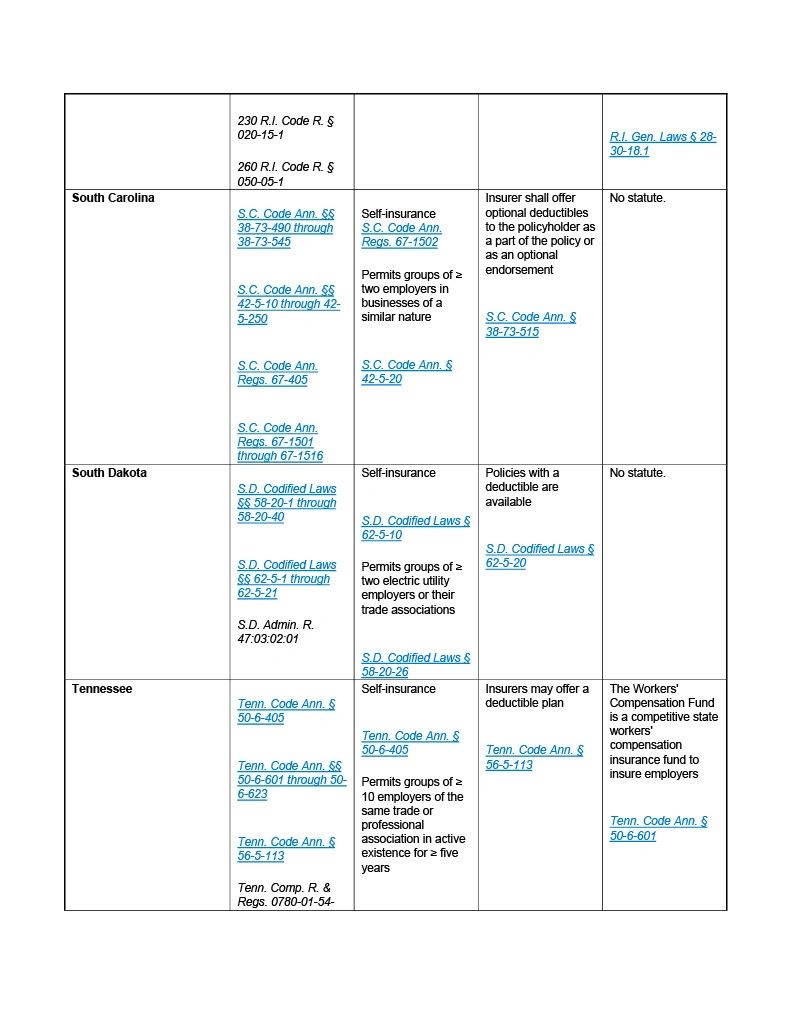

In this survey, we examine how employers are permitted to manage workers’ compensation liability coverage, including their option to self-insure, the deductibles associated with workers’ compensation insurance policies, and special statutory rules for coverage or claim payments.[i] This research comes from Lexis+ and their overview of the workers’ compensation systems in the various states.[ii] Herein, we review the laws of all 50 U.S. states, Puerto Rico, Guam, the Virgin Islands, and the District of Columbia. Workers’ compensation is unique in the United States in that each state makes its own rules regarding the governance of the coverage system.[iii] Because state laws and regulations govern these issues, federal law generally does not apply – or if they do, they only apply in certain circumstances.[iv]

Most states require employers to have workers’ compensation insurance and regulate who must provide it and the extent of coverage that is required.[v]States also impose a range of rules on both workers’ compensation and employers’ liability insurers, which may include specific policy requirements and business practices. In some states, insurers are allowed to direct care, or mandate that injured workers seek care through an employer directed panel of health care providers.[vi] We address these rules in more detail in a separate white paper.

Just about every state allows employers to self-insure for workers’ compensation instead of buying an insurance policy from a third party carrier.[vii]Before granting self-insurance status, states require employers to jump through a number of hoops to ensure that their injured workers are protected in the event of an industrial accident.[viii]An application for self-insurance is typically needed, and a state agency must approve it before the employer can self-insure.[ix]

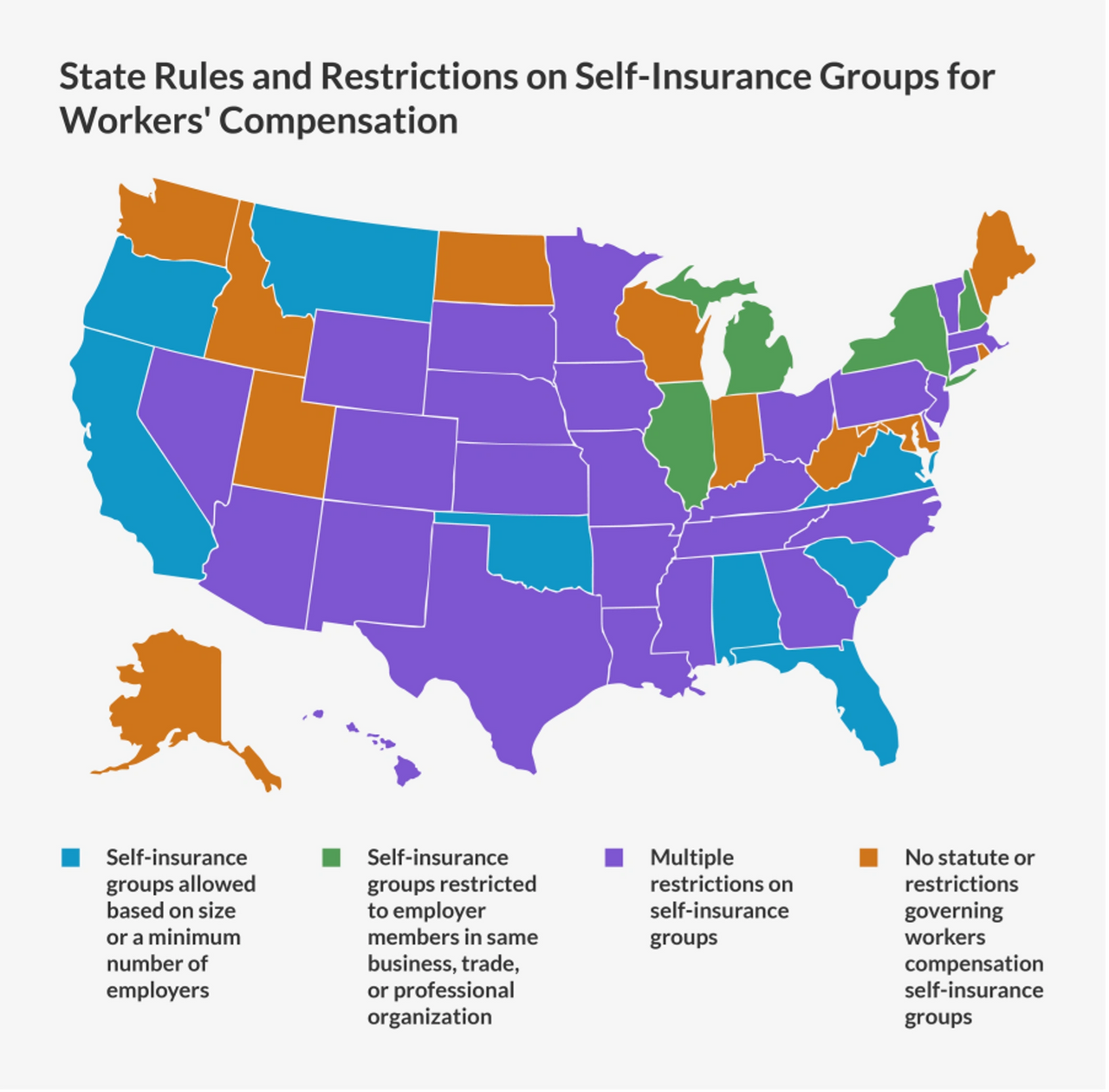

Self-insurance groups are another popular option that many states are now allowing for workers’ compensation.[x] Members of a self-insurance group pool their liabilities to cover workers’ compensation benefits for their employees.[xi] This allows smaller employers that otherwise would not qualify for self-insurance to join with other similarly sized organizations to become self-insured. Often, group members must be in the same industry or trade, and some states additionally require membership in a corresponding trade or professional association.

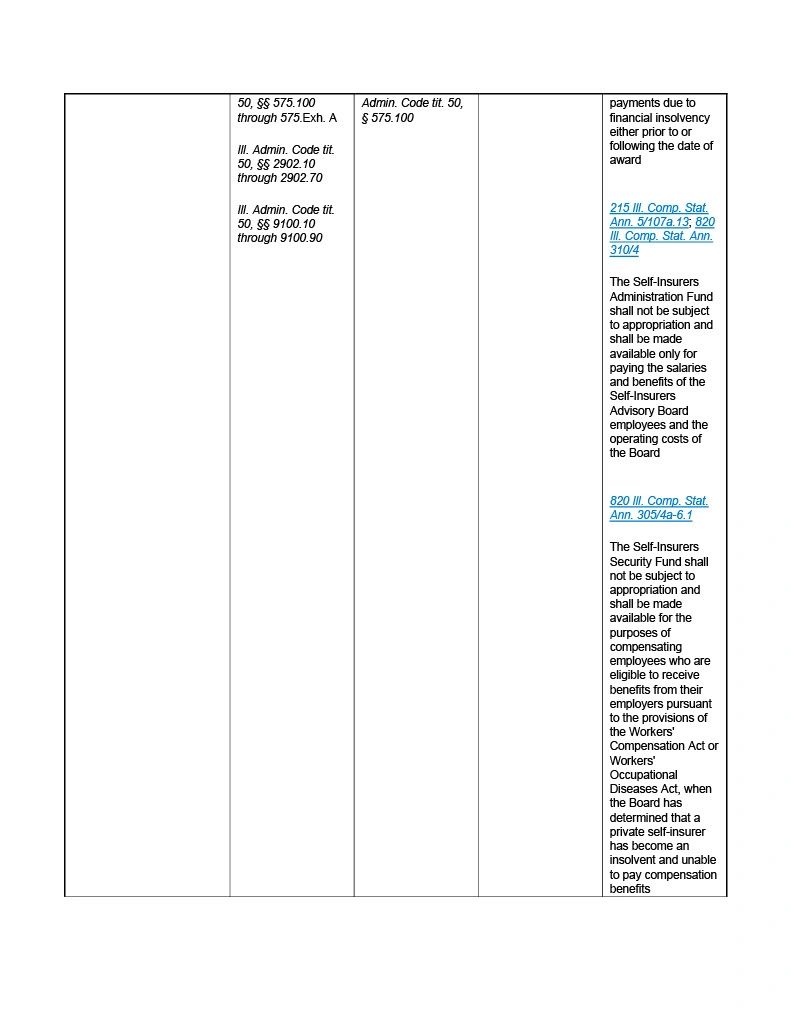

Also of note, a majority of states also require participation in an assigned risk pool in the event that an employer cannot obtain workers’ compensation insurance on the open market or self-insure.[xii] Finally, states may require self-insured employers or groups to contribute to a state guaranty fund.[xiii]This fund helps ensure that workers’ compensation claims are paid if a self-insured employer defaults or becomes insolvent.[xiv]

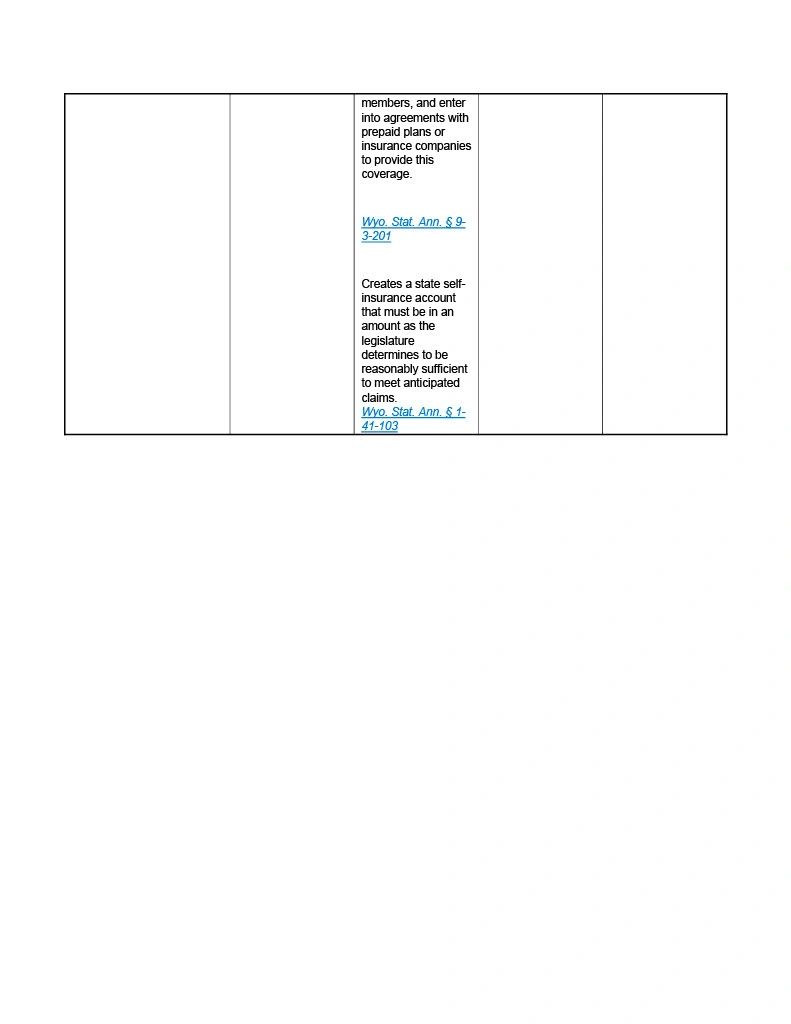

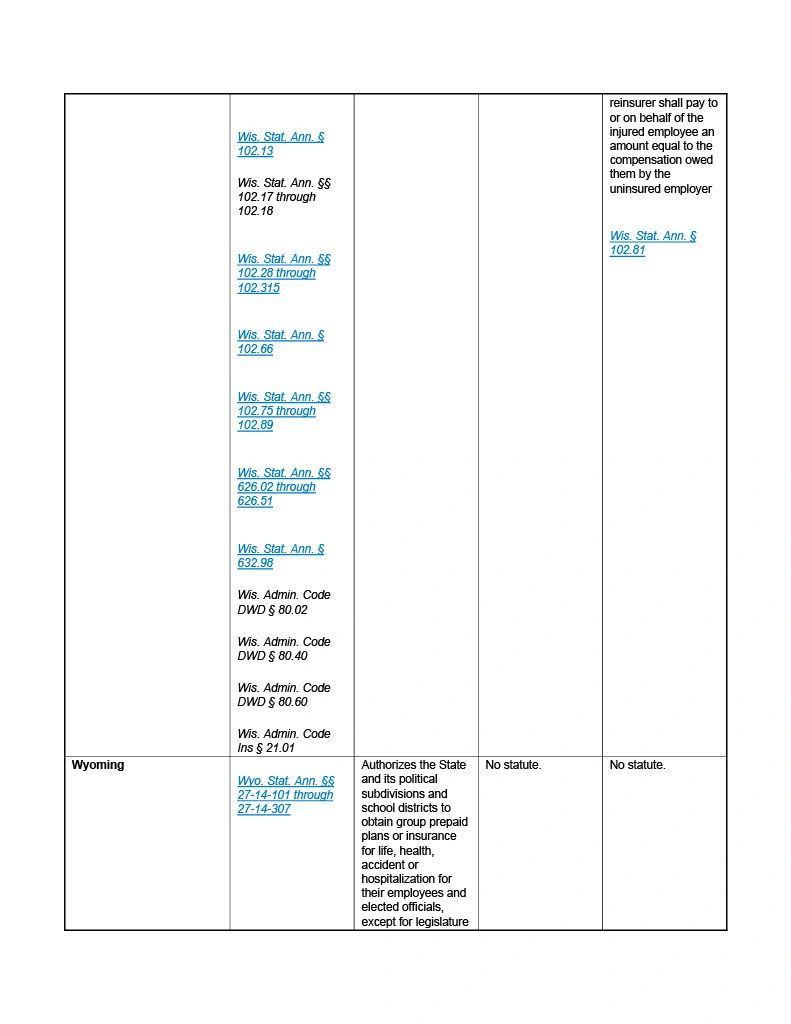

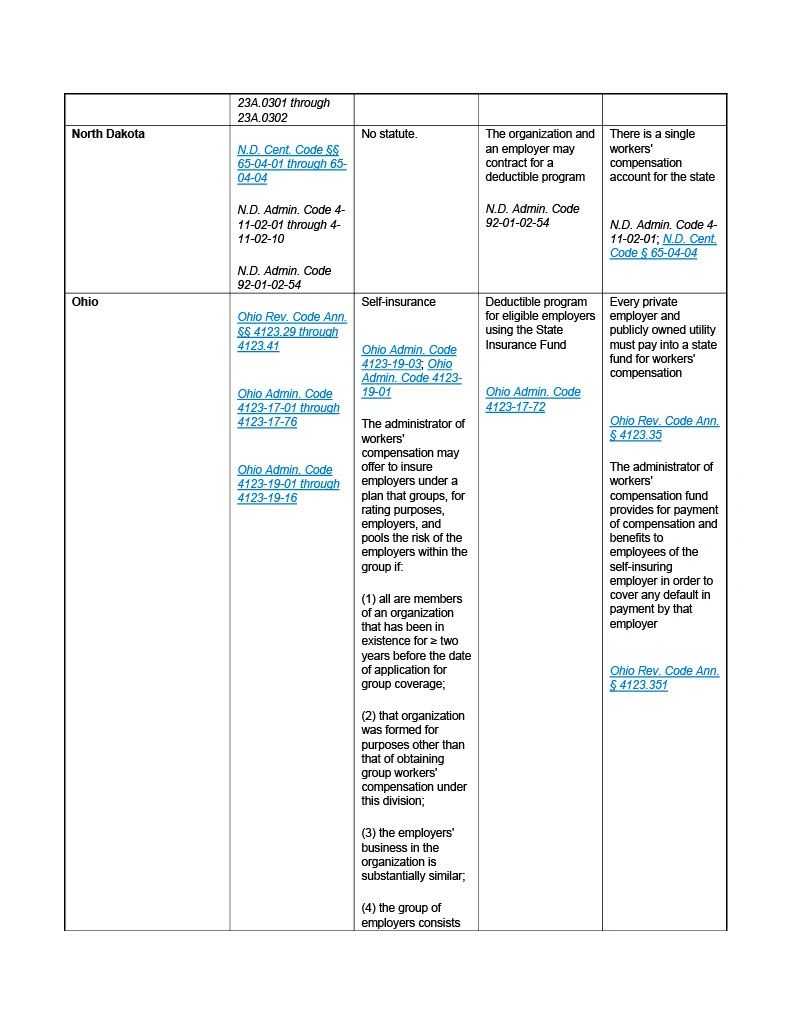

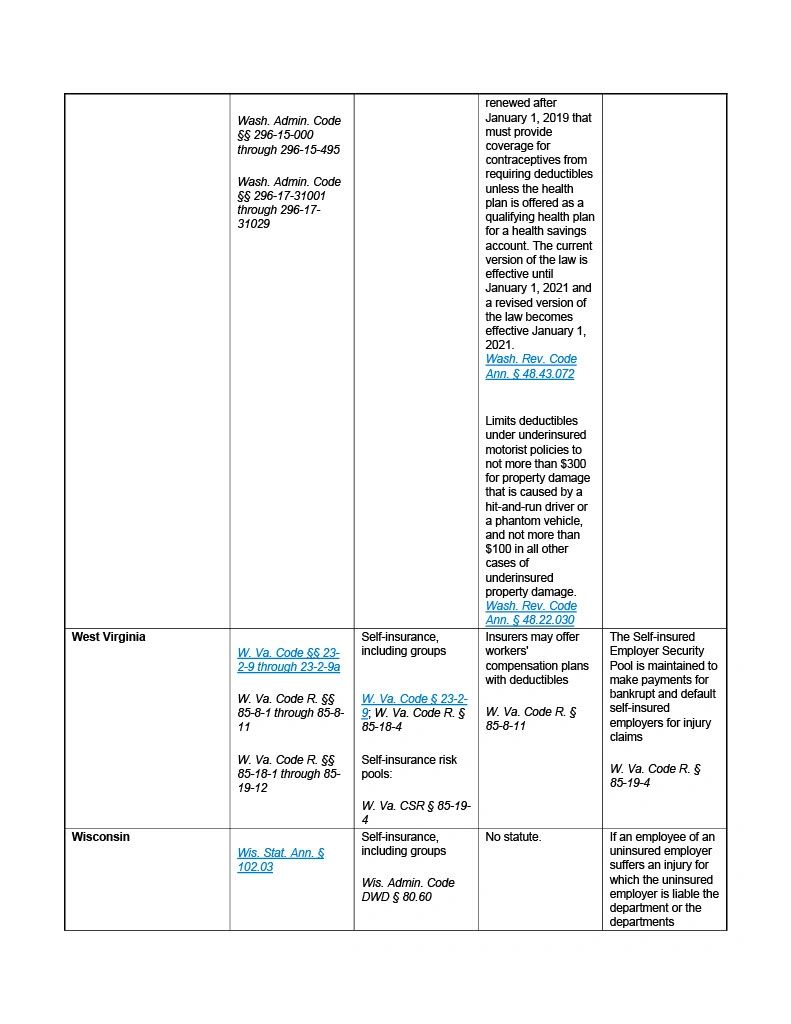

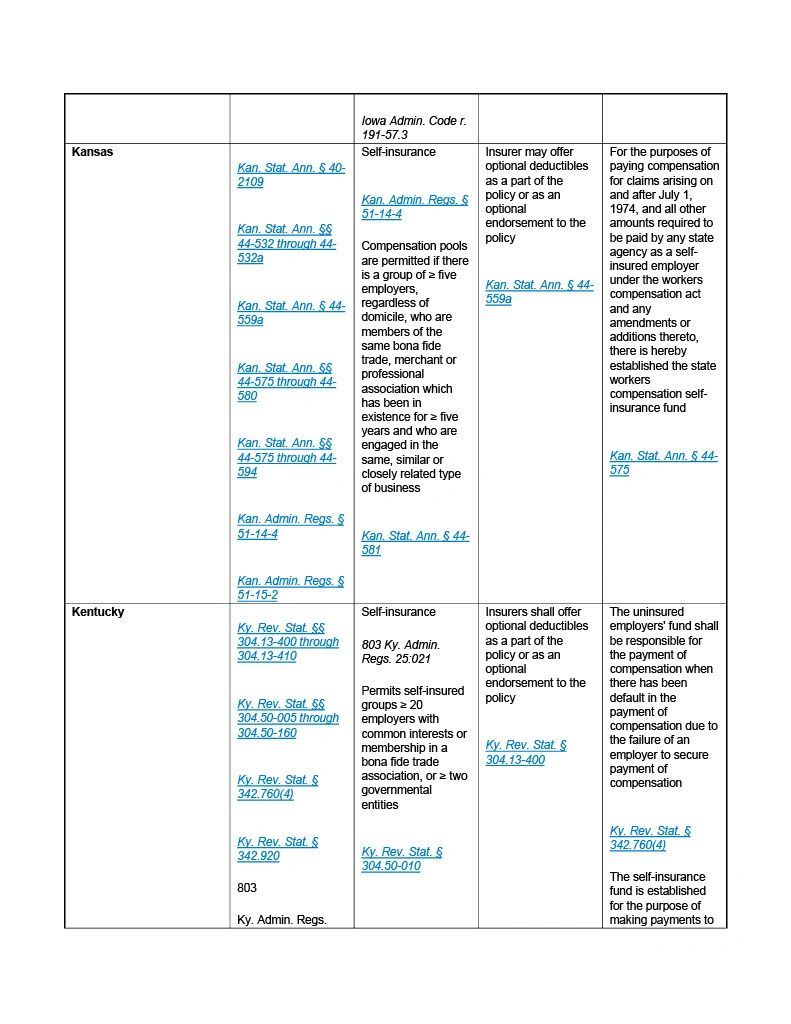

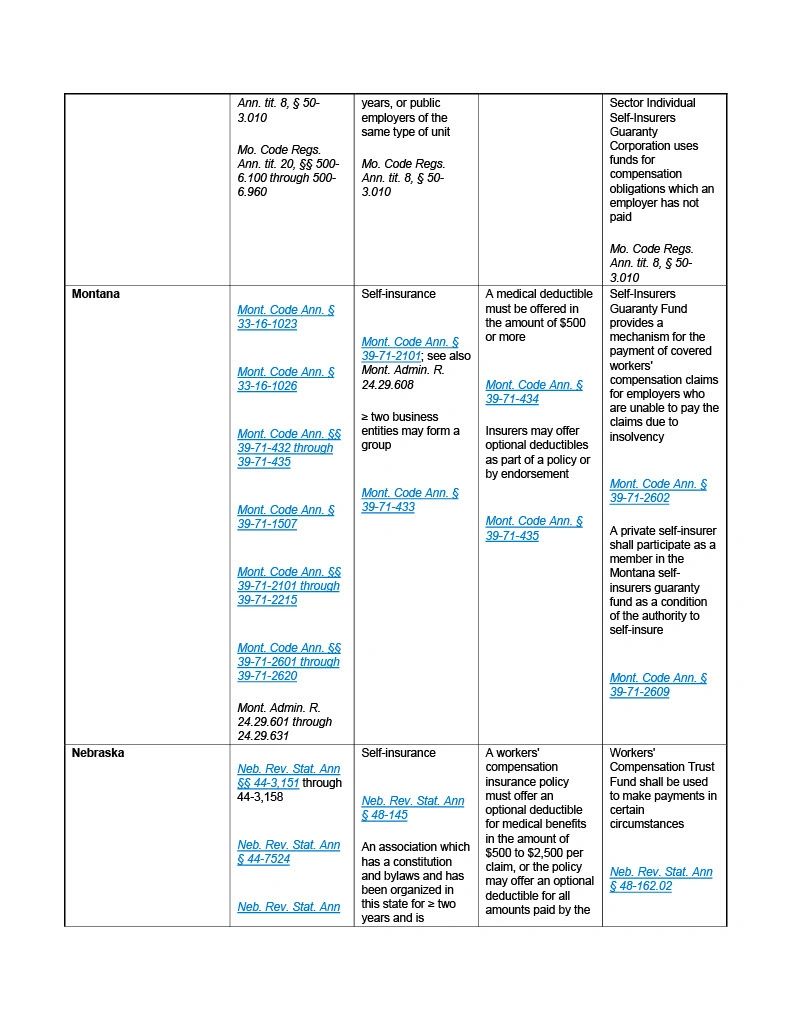

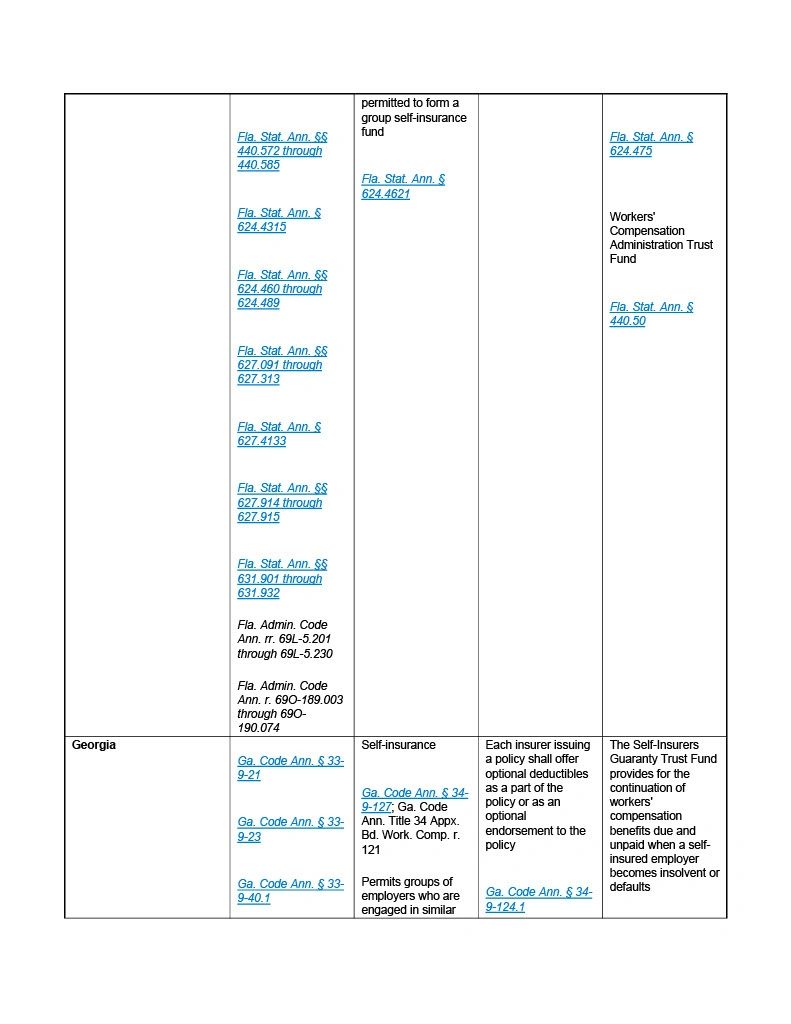

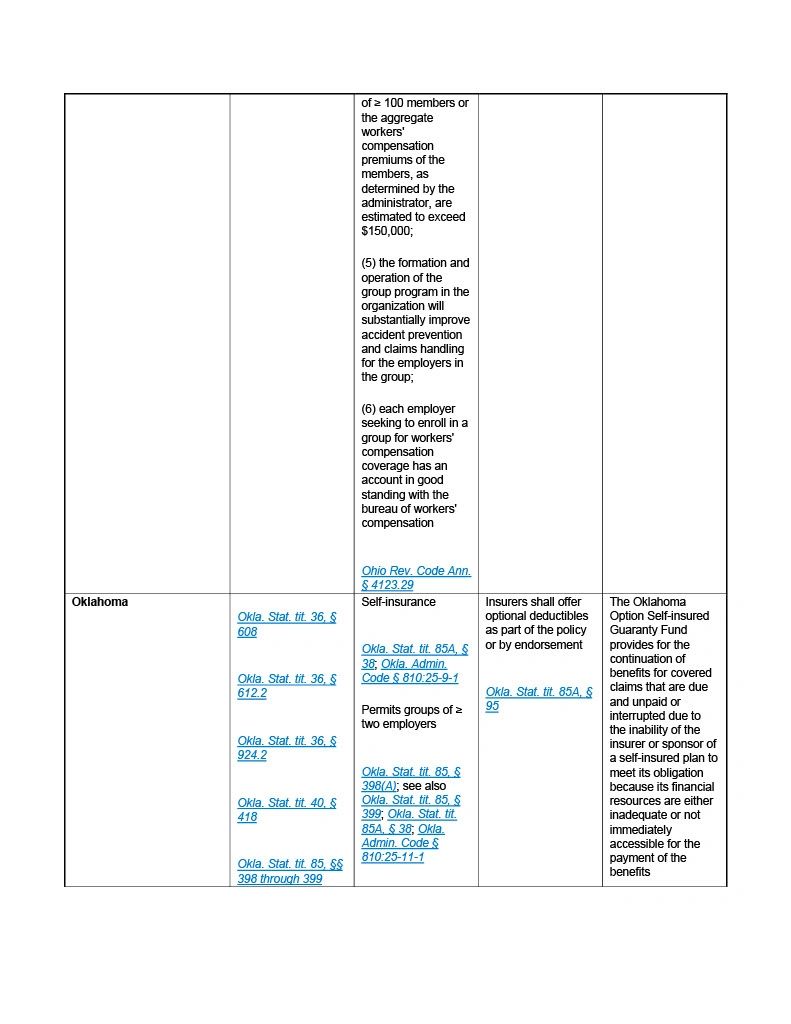

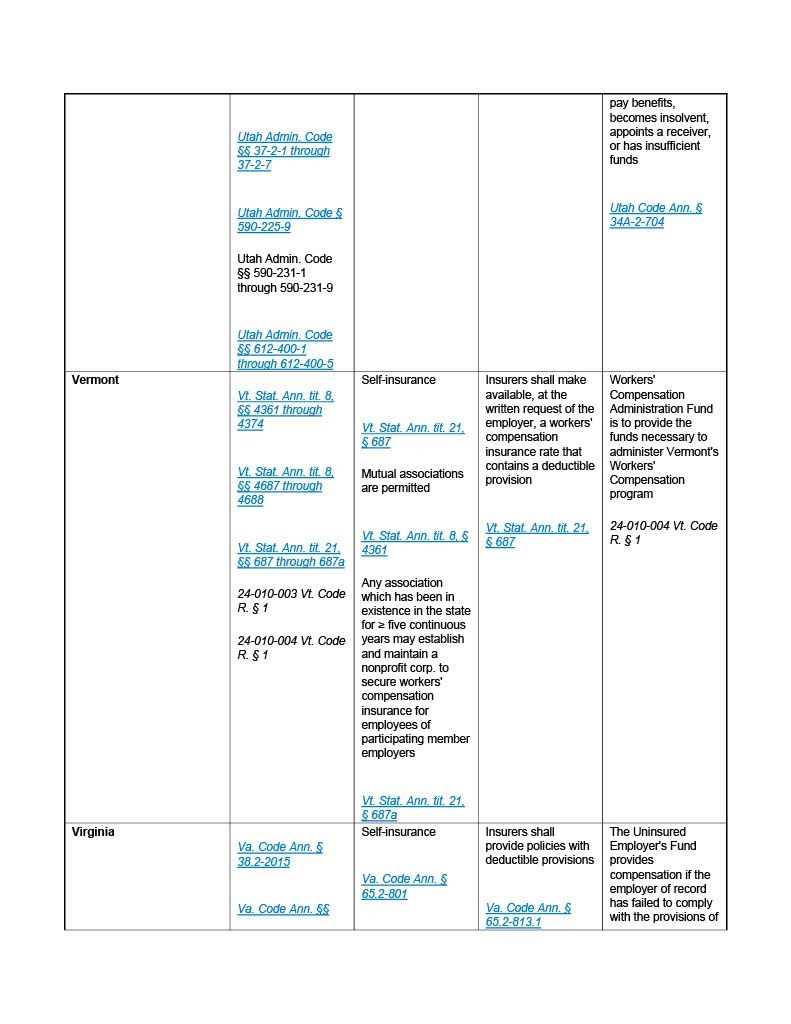

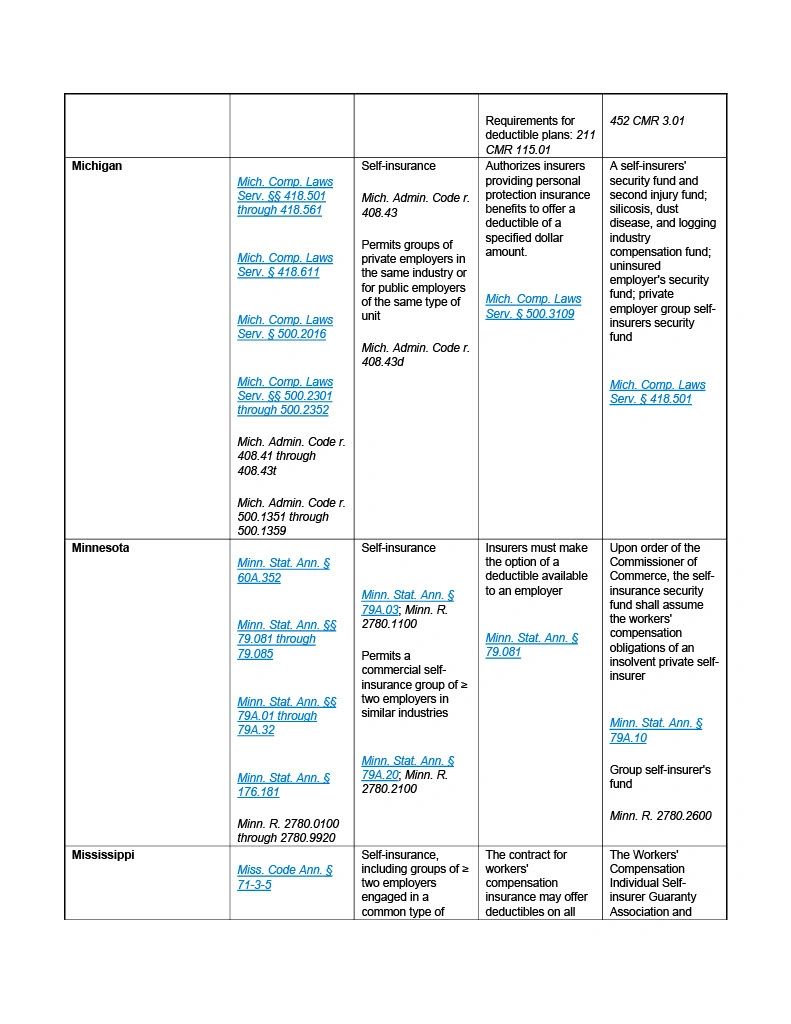

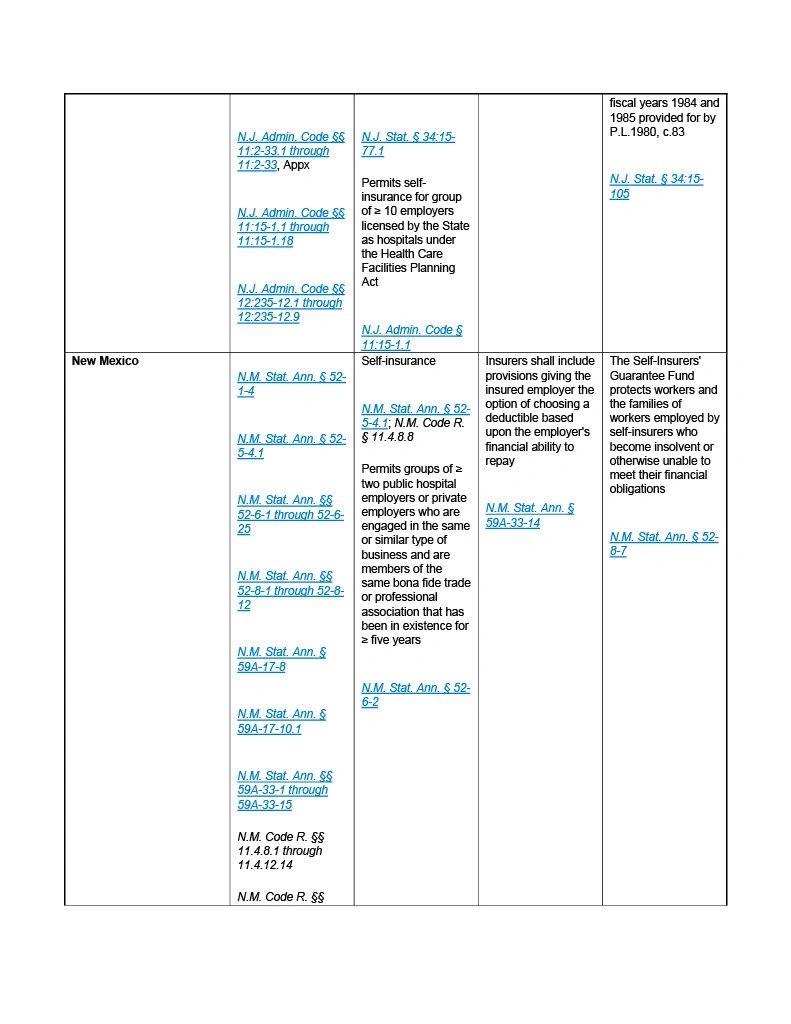

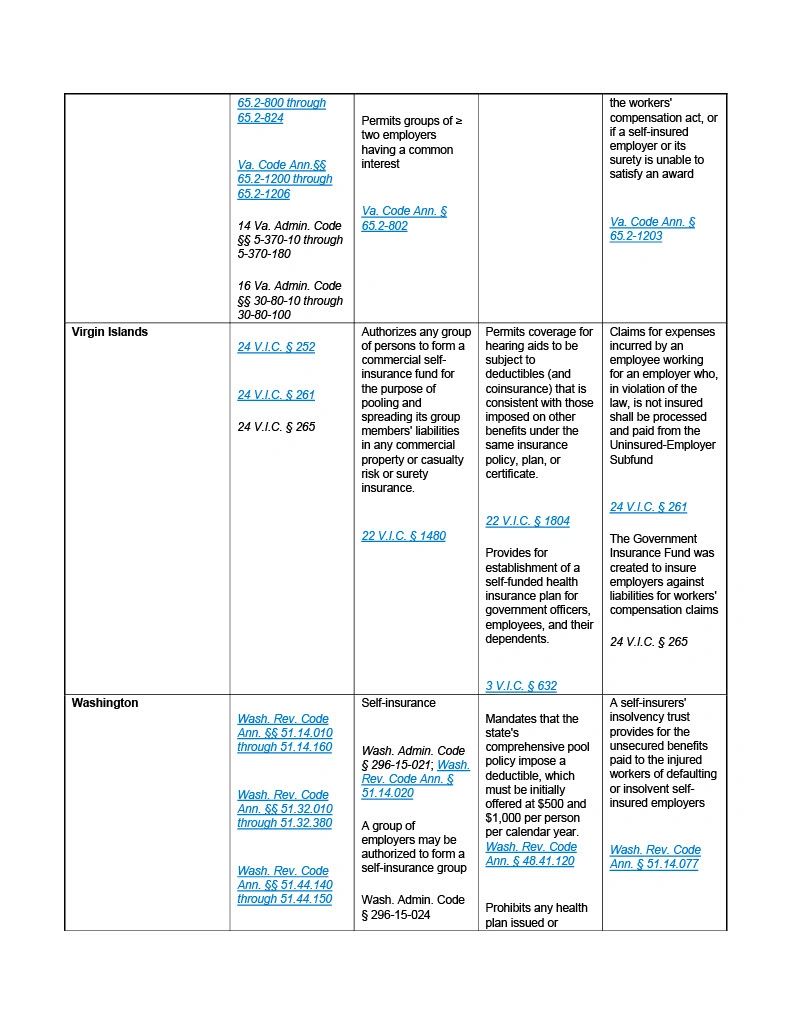

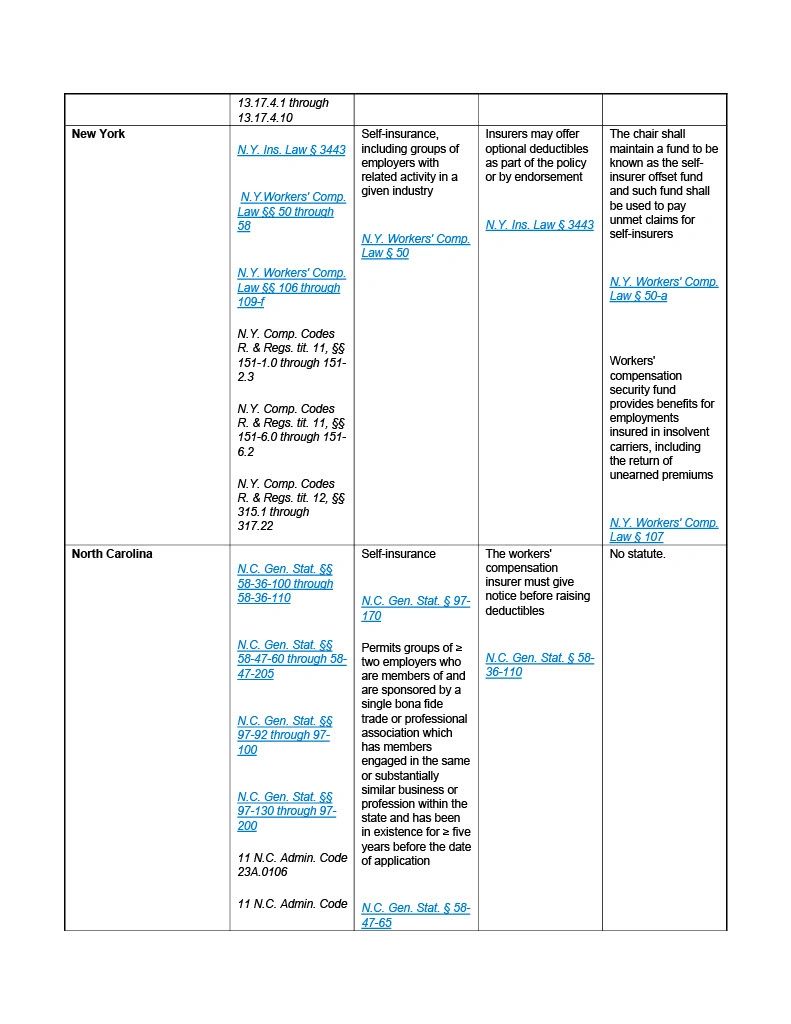

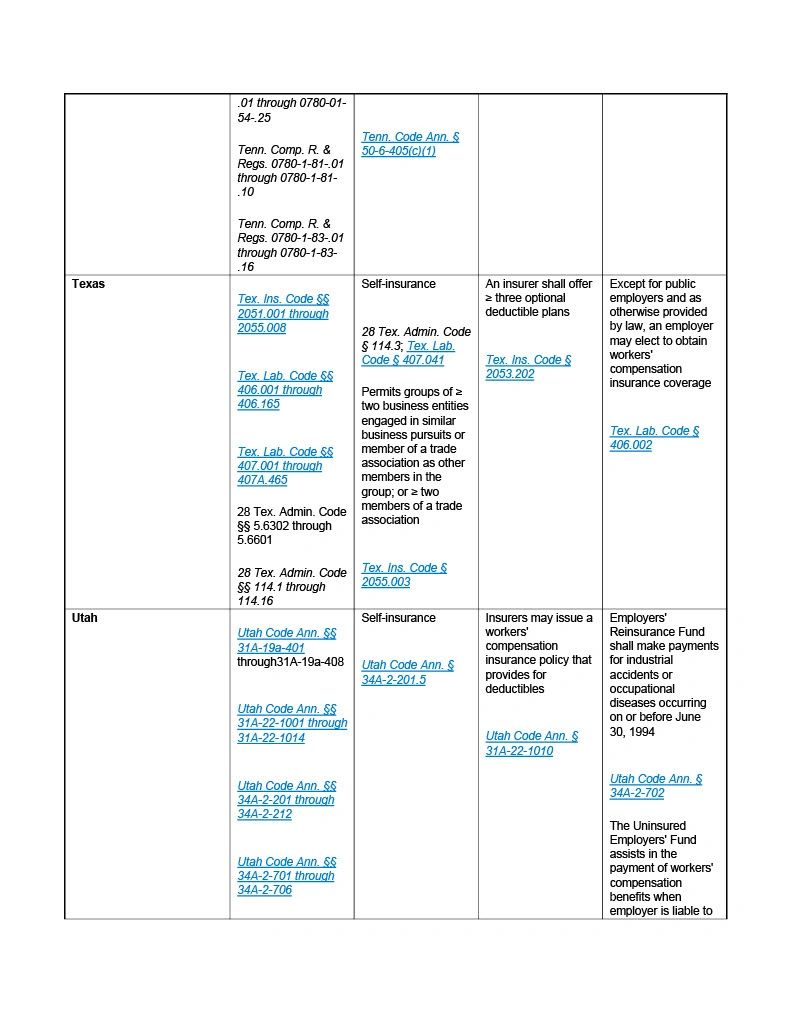

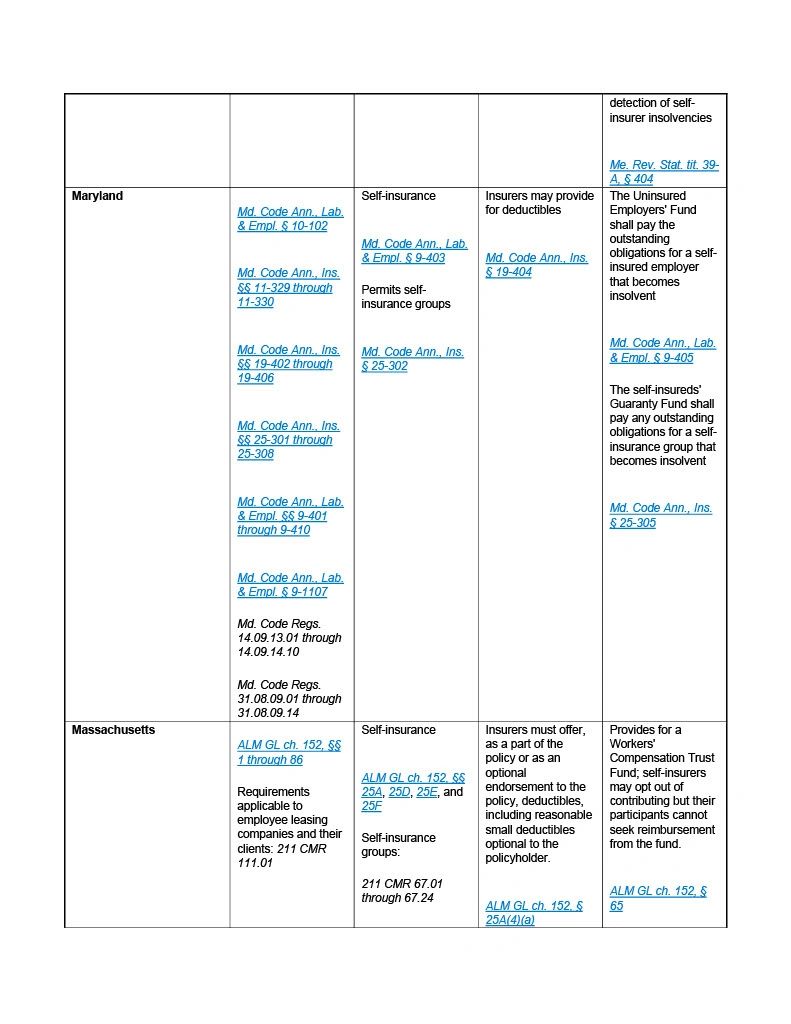

Below is a listing of the states with links to their rules and regulations related to self-insurance for workers’ compensation:

Current as of: 06/13/2024

[i] “Workers' Compensation Insurance & SSDI State Law Survey.” Lexis+.

[ii] Id.

[iii] “Insuring Your Business: A Small Business Owners’ Guide to Insurance.” Insurance Information Institute. https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/workers-compensation-insurance

[iv] “Workers’ Compensation: Overview and Issues.” Congressional Research Service. https://crsreports.congress.gov/product/pdf/R/R44580/7

[v] “A Brief History of Workers’ Compensation.” Iowa Orthopaedic Journal. https://pmc.ncbi.nlm.nih.gov/articles/PMC1888620/

[vi] “Does the Workers’ Compensation System Fulfill Its Obligations to Injured Workers?”U.S. Department of Labor. https://www.dol.gov/sites/dolgov/files/OASP/files/WorkersCompensationSystemReport.pdf

[vii] “Workers’ Compensation Programs.” Self-Insurance Institute of America. https://www.siia.org/i4a/pages/index.cfm?pageid=7534

[viii] “Self-Insurance – How it Works.” Safety National. https://www.safetynational.com/self-insurance-how-it-works/

[ix] “Workers’ Compensation Programs.” Self-Insurance Institute of America. https://www.siia.org/i4a/pages/index.cfm?pageid=7534

[x] “Insurance Requirements & Regulations by State.” Advanced Insurance Management. https://www.cutcomp.com/depts.htm

[xi] “Everything You Need to Know About Self-Insured Workers’ Compensation” Caitlin Morgan Insurance Services. https://www.caitlin-morgan.com/everything-to-know-about-self-insured-workers-compensation/

[xii] “The Ultimate Guide to Workers Compensation Insurance Requirements by State” Embroker. https://www.embroker.com/blog/workers-compensation-insurance-requirements-by-state/

[xiii] “State Guaranty Fund: What it is, How it Works.” Investopedia. https://www.investopedia.com/terms/s/stateguarantyfund.asp

[xiv] “If My Insurance Company Fails.” Texas Department of Insurance. https://www.tdi.texas.gov/pubs/consumer/cb006.html

AI california case file caselaw case management case management focus claims compensability compliance compliance corner courts covid do you know the rule exclusive remedy florida glossary check Healthcare hr homeroom insurance insurers iowa kentucky leadership medical NCCI new jersey new york ohio pennsylvania roadmap Safety safety at work state info tech technology violence WDYT west virginia what do you think women's history women's history month workers' comp 101 workers' recovery Workplace Safety Workplace Violence

Read Also

About The Author

About The Author

- Dennis Sponer

Read More

- Dec 18, 2025

- NCCI

- Dec 18, 2025

- Edward Stern

- Dec 16, 2025

- Niki Moore

- Dec 16, 2025

- James Benham

- Dec 08, 2025

- Daniel Richardson

- Dec 05, 2025

- WorkersCompensation.com