Share This Article:

- Simplified Business Model: As announced in September the company entered into a definitive agreement for the sale of Argo Underwriting Agency Limited and its Lloyd’s Syndicate 1200.

- Continued Growth in Ongoing Business: U.S. Operations earned premiums increased approximately 2% from the prior year third quarter, while earned premiums from U.S. ongoing business[1] grew approximately 14%, primarily attributable to business lines where the company retains more of the risk on a net basis.

- Reduced Catastrophe Losses: Total catastrophe losses of $23.4 million were 14% lower than the third quarter 2021 despite elevated industry catastrophe losses; reflects strategy to reduce catastrophe exposure.

- Delivered Expense Reductions: Expense ratio of 35.4% improved 0.9 percentage points from the prior year third quarter, driven by ongoing cost reduction efforts.

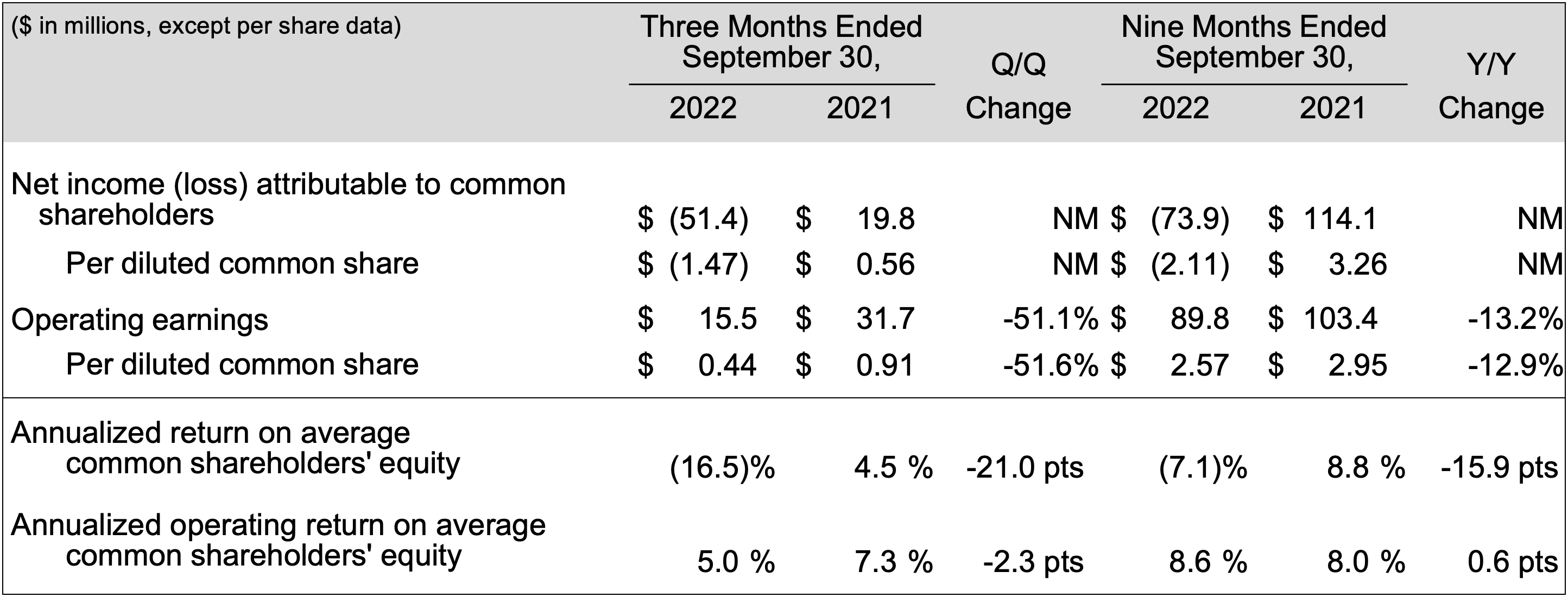

HAMILTON, Bermuda – November 7, 2022 – Argo Group International Holdings, Ltd. (NYSE: ARGO) (“Argo” or the “company”) today announced financial results for the three and nine months ended September 30, 2022.

“Over the past two years, we have transformed Argo, better positioning the company to advance our business strategies,” said Argo Executive Chairman and Chief Executive Officer, Thomas A. Bradley. “In September, we announced the sale of our Lloyd’s operation, which marks a significant milestone in Argo becoming a focused, pure- play U.S. specialty insurer. Importantly, this transaction further simplifies our corporate structure, enables greater focus on our diverse portfolio of profitable and scalable U.S. specialty businesses, and better positions us to explore additional strategic alternatives to maximize shareholder value.

“Argo’s third quarter financial performance benefited from growth in earned premiums in attractive business lines, reduced underwriting volatility, and lower expenses. In particular, our U.S. operations produced a strong current accident year performance primarily driven by disciplined underwriting and positive rate continuing to earn through. While our thoughts are with those impacted by Hurricane Ian, we are pleased the company’s quarterly catastrophe losses once again decreased year-over-year despite elevated industry catastrophe losses. These results are a testament to the success of our volatility reduction efforts through exiting businesses with property catastrophe exposure.”

Read Also

- Apr 03, 2025

- WorkCompCollege

- Mar 18, 2025

- WorkCompCollege

About The Author

About The Author

- WorkersCompensation.com

More by This Author

- May 18, 2023

- WorkersCompensation.com

- Feb 08, 2023

- WorkersCompensation.com

- Feb 07, 2023

- WorkersCompensation.com

Read More

- Apr 03, 2025

- WorkCompCollege

- Mar 18, 2025

- WorkCompCollege

- Mar 12, 2025

- WorkersCompensation.com

- Feb 27, 2025

- WorkCompCollege

- Feb 26, 2025

- Horizon Casualty Services

- Feb 18, 2025

- WorkCompCollege